A Soft-ish Landing

where's retail?

What’s good gals & fellas! Hope everyone has been enjoying their summer and have avoided at least some of the carnage that has hit the stock market, job market, and crypto markets. It’s been about five months since I’ve written something on here and a metric ton has happened across markets globally and many isolated events specific to crypto. I could spend a lot of time summarizing everything that’s happened but I’ll try to keep it short and save a longer recap post for another time. I would be tweeting as I’m watching charts but I’ve decided to take a break from twitter after checking my daily screen time the other day, so again I’m writing here instead. NFL preseason is also back so I finally have something to watch other than candlesticks now, shortly I’ll begin my yearly delusion of convincing myself the Eagles will complete the season with at least 12 wins.

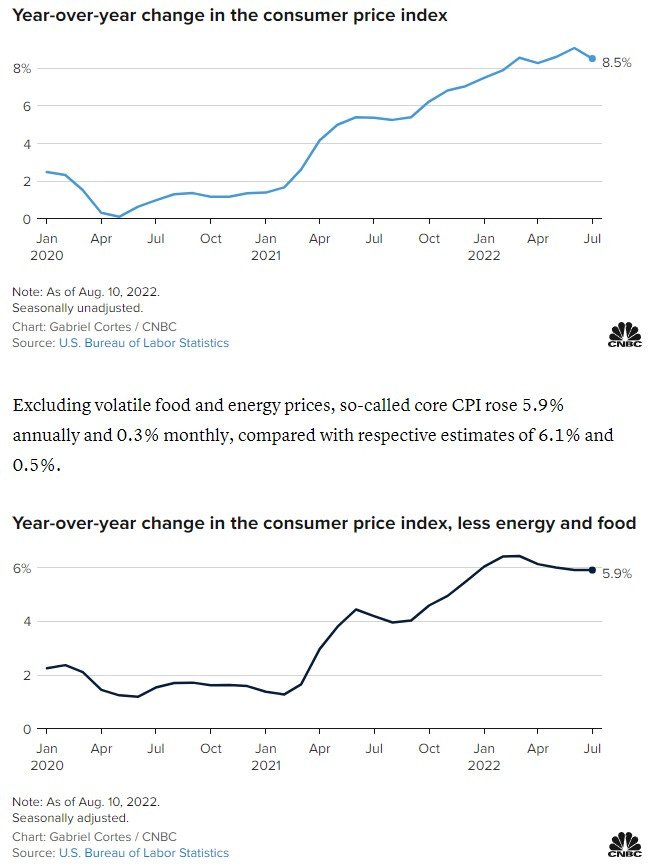

In the past week we’ve seen traditional markets respond positively to the first sign of inflation slowing in the economy and crypto has continued to follow.

"Consumer prices rose 8.5% in July, less than expected as inflation pressures ease a bit"

The bottom tick a month ago on July 13th was the day of the record high inflation print of 9.1% CPI year over year, most market participants were (and still are) surprised that markets rallied so hard on the back of such poor data, but markets are forward looking & many allocators who bet long into a cash heavy market predicted that’d be the peak of bad news, so far they are been proven right, what remains to be seen is if these conditions will continue. This year we’ve seen arguably the worst slew of liquidations of retail, and also institutional participants, from a pure wealth destruction perspective than any other cycle in crypto’s history. LUNA’s implosion in May erased nearly $60 billion from the total crypto market cap, taking down many other alts alongside it and causing cascading effects across the ecosystem. The hedge fund Three Arrows Capital blew up ~$10B the following month in June after not being able to make margin calls as BTC broke beneath $28k and ETH under $1700, effectively bankrupting multiple of the crypto lenders in the space. If anything should be clear, it is that nearly all leverage has been wiped clean from the system, whether that be retail on perps on institutions borrowing billions. On the bright side, it is highly unlikely we see any forced selling of that magnitude any time soon, and when bottoms are formed after events like these they tend to be strong support levels moving forward because of how much capital was required to absorb all of this extra sell pressure. So where does that leave us? With our good friend Mr. Powell and trad indices to lead the way. The following is what I think that could look like over the next few weeks before eth becomes supergigaultrasound money, and again, none of this is financial advice.

Macro and the BTC500

Crypto has traded almost directly 1 to 1 with traditional markets for most of the year, as many crypto traders ignored the gravity of the FED’s pivot and high inflation warning signs that appeared late last year. This downswing has been exacerbated by the two liquidation events mentioned above as crypto markets got hit substantially harder towards the end of the downtrend. With the crypto-specific implosions over, if traditional markets return to risk-on I think one can deduce that crypto markets will as well, we are already seeing this play out over the past month or so. Although, I think it’s definitely possible that we see extended sideways from cryptos like BTC, as other alts with narratives recover faster. In early 2020, the Nasdaq actually recovered much faster than BTC did, off the backs of the FED’s covid pivot. BTC didn’t really trend hard until Q4 later that year after the first DeFi summer.

From a technical perspective, the major indices SPX500, Nasdaq, and QQQ have all recently reclaimed bullish market structure on their weekly charts, forming higher highs over the last swing high before the lows. In April, we had a bear market rally that looked similar, but the indices were unable to close higher before taking the highs and continuing their downtrends.

On the daily we’re coming into local resistance now and should see a pullback soon, above here the next area of resistance is around the Q2 highs. If we do get a deeper pullback it should be this week across the board on assets and that’s a dip I’d look to buy, bulls don’t want to see this trade back beneath ~4080, which is when it would likely be another false breakout like early April.

From a fundamental perspective, markets are hoping that Powell can orchestrate the elusive soft landing that they’ve been targeting all year, which would be in quite stark contrast to the crypto crash that has occurred at speeds not even seen on F1 racetracks. The FED is walking the tightrope between high rates negatively affecting consumers and an economy with high levels of debt vs. reducing high inflation that is also negatively affecting consumers, more aggressively so those with less cash on hand. The most recent rally is a direct result of jobs data coming in strong combined with inflation readings starting to come down. If these trends continue in the same direction then the FED won’t need to hike as aggressively, and they’ll be able to pause at some level that they deem market neutral. People asking for a return to near zero rates and QE are huffing hopium fumes in my opinion, but I don’t think that’s completely necessary for markets to stop going down, at least for them to start trading sideways with outperformance by certain individual names. The downside possibilities that could not be priced in would be: Eurozone energy crisis worsening, escalation of the Russia-Ukraine conflict, some intervention by Taiwan in China, and the downstream effects of accelerating QT.

Good thread on bank’s earnings reports & their viewpoint on consumers, most have said that although they are wary of the changing economic conditions, they don’t expect anything like ‘07/’08.

Payrolls increased 528,000 in July, much better than expected in a sign of strength for jobs market - Market has actually been responding poorly to jobs beats until recently, since the expectation has been that this will allow the FED to hike more aggressively. I think that this could change soon if markets start to price in the possibility that inflation may be trending down with rates where they are currently alongside a healthy jobs market.

Upcoming Dates

August 25th: Jackson Hole FED Meeting

September 2nd: NFP numbers

September 13th: August CPI

September 15-16th: ETH Merge

September 22nd: FOMC

We have a 4-5 week window before the important new data points & FED guidance, expecting markets to put in a higher low & keep rallying the next few weeks, plan to de-risk ahead of the merge & FOMC. If we see the same trends with jobs data and CPI next month it seems unlikely that we breakdown to new lows soon. Markets this year have been very news driven based off FED’s language/actions and economic data, which will likely continue, ability to be fluid in your biases is crucial given the backdrop. Invalidation for continuation up is pretty clear on trad & crypto charts, should have confirmation whether this is the top of a bear market rally or trend shift in the next couple weeks. One of my mistakes earlier this year in April was not sticking to my own plans and de-risking quickly if we failed to hold above range highs, do not recommend.

Charts, Narratives, and other fun stuff

Ethereum

ETH has dominated since the low from the CPI print a month ago, with ETHBTC ripping 50% and Ethereum outperforming various L1s and other large cap coins. The only alts that have been able to keep pace with Ethereum have been coins connected to the merge like Optimism, Lido, GMX, DPX, and others. At the beginning of the year I wrote about how I thought the better play for the merge was the tokens associated with L2s since it is necessary for rollups to attract much more activity for ETH to be given a much higher valuation as a settlement+DA layer. OP was the first instance of this and I believe we will see the same trends happen across the board as other L2s launch tokens, Arbitrum being the next L2 planning to do so. Regardless, ETH is the only liquid bet that large players can make to bet on the merge and it has a much better narrative than BTC currently, which has the Mt. Gox coins being released to users at the end of the month, following a dismal performance alongside other risk assets during this period of high inflation. Another reason for ETH’s outperformance was that the liquidations in June were largely isolated to ETH & BTC, so this rally was also in part undoing that forced selling. If you look at the charts of most altcoins you’ll see that a lot of them did not break beneath the lows from the Luna implosion, highlighting the difference here between retail capitulation and institutional capitulation. I don’t think I’ve ever seen BTC & ETH lead a market wide selloff in crypto before without most alts getting hit much harder.

For those who are unaware, the merge references ETH’s transition from proof of work to proof of stake, a change in its’ consensus algorithm. It is a vitally important piece of the longterm roadmap for Ethereum, which plans to move most of the execution for everyday transactions to rollups. I’ll attach some articles below that describe rollups in a lot more detail, but put simply, rollups are blockchains that compress groups of transactions that they perform into a single proof that a smart contract on Ethereum can verify as true. Since it is much cheaper for ETH to verify these proofs of off-chain transactions instead of doing all of these transactions on its’ base layer, it is able to scale to support more users without them paying exorbitant fees. The merge is not what makes this modular architecture possible as rollups already exist on ETH’s mainnet, but it lays the groundwork for many further network improvements that will make Ethereum more efficient as a settlement layer for these rollups. The Bankless guys did an interview earlier this year with Vitalik going over the changes in detail

Vitalik's An Incomplete Guide to Rollups

Delphi Digital: The Complete Guide to Rollups

John Adler: The Why's of Optimistic Rollups

Ground Up Guide: zkEVM, EVM Compatibility & Rollups

Dips below 1800 should be for buying, invalidation similar to SPX with ~1650, would risk off *if* we start seeing HTF daily closes beneath there. If we lose the summer lows, this looks more like a deviation at resistance and it’s likely we’d test lower $1ks again. Expecting 1650-1800 to hold as support and this to push higher > $2k+ going into the merge in mid-September.

DOGE & SHIBA INU

I got an alert for SHIB breaking resistance Saturday night, one that I was not expecting to go off for a few weeks. The DOGEBTC chart starting to trend hard can only mean one of two things historically, either we are reaching the end of altcoin rotation roulette, or we are starting the beginning of a new trend. Given the backdrop I’ve been outlining above I’m currently leaning towards it being the latter, so let’s see if retail is still alive and kicking.

DOGEBTC has found a local bottom directly on top of its old all time high peak from 2014. If you look at this chart next to the TOTAL2 chart that depicts the total market cap of all altcoins, you’ll see that doge is commonly a leading indicator for retail attention entering the markets and altcoin trends tend to start shortly after. It has been around 450 days since DOGE topped with Elon speaking on SNL, so there’s definitely been enough time passed for a new trend to start. I don’t know whether SHIB or DOGE is the better play atm, since SHIB has a much stronger community oriented presence, and does not have a founder that hates all of crypto nor a moon man who publicly dumped on people, but DOGE currently has its’ own dogechain for people trade doge alts on so I guess we’ll see. In the past week, activity on the wall street bets reddit started to rise again around playing options on names like Bed Bath and Beyond and AMC. If you traded markets in 2021 then you remember the Gamestop → Dogecoin rotations and how correlated a lot of those moves were. I didn’t even know there was a dogechain that existed until a few days ago, so I’m curious to see if we get anything similar to the binance smart chain season that we had in 2021, but instead this time with competing doggy dex forks.

One significant change in markets since covid is the normalization of everyone trading stocks and crypto and I don’t think that is changing anytime soon. Although we don’t have helicopter money falling from the sky this time around, as long as people are working there are going to be more and more ppl trading in their spare time and watching crypto markets. Shiba does not have any fundamental merit as a technological innovation in crypto nor as a DeFi primitive or even as a metaverse play, well at least not yet. It is driven solely by memes, community sentiment, and the reflexivity of retail interest + crypto native capital + funds betting on the former. The most effective way to get retail’s attention is price going up and doggy coins going parabolic seems to do that every time. If I’m wrong and this isn’t a new trend starting, then this would be the last rotation before the end of a bear market rally. If you remember how Doge & Shiba traded last year then you’ll know that they suck attention and capital away from the rest of altcoins when they trend hard. To protect against this case I’m keeping BTC & APE hedges for now, would love to be forced out of these positions by BTC squeezing higher from 24k to 28k.

From a technical perspective, the chart is pretty straightforward, 3 month range breakout after testing near the lows from last summer’s accumulation range. These tend to trend aggressively so if it bleeds back down over the next few days that’d be a bad sign.

Google trends on this & doge peak near same day the top is printed every time, for now people don’t seem much interested yet.

Solana

My personal favorite coin from 2021, Sol was the leader for most of the market cycle and the first L1 trade that stood out other than BNB. As Ethereum transitions to a modular network architecture, moving most of execution to rollups, Solana will be the primary monolithic L1 attempting to handle everything on its’ own at the base layer. Over the past year Solana has grown a lot as a network, experiencing many growing pains along the way. Solana’s sealevel runtime implements parallel transaction processing, which allows it to process transactions much more efficiently than the EVM. Its’ low fees have been very attractive for retail users, as we’ve seen with Solana’s sustained growth in the NFT space. Although the low fees have been great for users, they’ve also been abused by bots spamming transactions, usually around NFT mints and have caused the network to crash on more than one occasion. For Solana to reach the next level I think you’ll need to see increased usage of their DeFi applications, some of which like Drift and Friktion have started to do well over the past few months. There has also not yet been any games with high TPS launch on Sol [waiting on you Aurory], so it’ll be important to see if Solana can handle many micro transactions in the same way Avalanche’s subnets do.

Overshadowed by Ethereum’s merge, Solana’s efforts to address their network issues have flown mostly under the radar. Quic/Qos/localized fee markets implemented in one of Solana’s most recent network upgrades are critical advancements to help prevent congestion during peaks in network traffic and provide a better experience for users. Personally, I would’ve called this Solana 2.0, but I guess the official 1.10.32 patch number is fine also.

Here is a great thread detailing all of the Solana Upgrades by @0xSanny

In summary, quic is the protocol used by validators that will allow block producers to rate limit bots and handle congestion which was not possible with UDP. Localized fee markets will function just like fee markets do on Ethereum, but instead of fees being affected globally across the network they will be specific to the part of the state that is being throttled, this specification is possible because of Solana’s runtime that allows parallel transaction processing. To give an example, on ETH whenever popular NFT mints happen it is impossible to use the entire network as gas fees spike extremely high, in contrast with localized fee markets, fees on Solana would only spike for users interacting with that specific mint, allowing the rest of the network to continue functioning without pause. Stake-weighted quality of service ensures that nodes are entitled to a % of packets delivered to the leader equivalent to your stake, which disallows bots w/ high % of stake or no stake at all to overrun others. These changes are live on mainnet now, so we’ll see over the next few months whether the changes make a significant difference in the network’s performance.

TA-wise want to see a clean breakout above $48.5 for new trend to start, looking to buy dips from $40-42 with invalidation beneath last week’s lows.

Chilliz - https://www.chiliz.com/en/

Chilliz has been one of the most successful crypto teams to achieve a market fit with consumers in the real world. They operate as a fintech provider specifically geared towards sports and entertainment companies, some of their notable collaborations include FC Barcelona, Juventus, UFC, 13 NFL teams and others. Many sports clubs now have their own associated tokens w/ CHZ through their Socios.com application, which allows fans to interact with their favorite teams. If I watched futbol in addition to CHZ I’d be trying to figure out which teams tokens to buy, but I have no idea who is good or not in any of those leagues over there. The app isn’t live in the US yet but plans to be coming soon. Recently they announced a partnership with FC Barcelona detailing their $100M investment to help support their NFT and metaverse plans and has quietly been outperforming most other alts since the beginning of August.

Socios Owner Invests $100M in FC Barcelona's Web3 Efforts

Currently CHZ exists as an ERC-20 token that fans use to purchase fan tokens of the associated teams on Socios.com that operate on their sidechain Socios. Later this year they’ll be launching their own layer 1 blockchain Chilliz 2.0, which will be an all-inclusive hub for teams to interact with their fans through various decentralized applications. I know that they have partnerships with teams in the US but don’t think any of them are nearly as big as they are in Europe with multiple teams. If they are able to effectively replicate their success here they could monopolize most of this NFT x fans x sports market since there is not a lot of competition.

It has recently just reclaimed it’s lows from last summer, breaking out to new highs the past three weeks. Upcoming resistance around ~$0.30 and support levels the s/r flip around $0.15-17

XMON - https://sudoswap.xyz/#/

Sudoswap, aptly referred to as the Uniswap for NFTs by Sisyphus, is an AMM that attempts to make your illiquid jpegs more liquid. NFTs have been arguably the most successful meta in onboarding new market participants to crypto over the past year, but there hasn’t really been a way to capture upside unless you were an expert jpeg flipper or in the opensea seed round. Here is a post detailing the idea from over a year ago.

The thesis is pretty simple, a platform that allows users to more efficiently trade NFTs, with the ability for natives to creatively build different pools w/ their own specialized bonding curves on top of it. Instead of a centralized marketplace that takes a fee cut every time you make a trade, sudoSwap is fully decentralized onchain with no fees while also providing users an easier way to buy and sell. The main obstacle for this will be whether liquidity moves over, but the trends over the past month or so look good so far. Don’t think the chart matters much for this one at this point in time, whatever it gets priced at should be tightly coupled to how much user activity increases or decreases over the next few months. Given that it’s only been live for about 30 days and it’s already doing ~10% of OpenSea’s volume you’d expect that to increase if retail comes back significantly, especially if natives create gamified collections using the curves creatively.

sudoSwap Dune Analytics

Current Thoughts

My current thesis for the next few weeks is that institutions have absorbed the worst of the selling on majors, so now we will see some chop as others get positioning ahead of the merge. I don’t think it’s likely that we see new lows soon, but to hedge against this BTC is the best short considering its’ lack of narrative and general weakness against the rest of the market. The BTC cash wealthy investor cohort are like gold bugs but slightly more forward thinking and they are buying spot with a 10 year+ outlook, not leverage longing range highs. Retail is still not *yet* in ape mode, but we should see retail slowly come back into markets if the recession narrative starts to fade. In my opinion right now the best way to express this bullishness on retail’s return is through dog coins, on-chain options, and jpeg shitcoining, which is why I think you’ll see select alts do well while majors put in a higher low. I also like Chilliz, it is one of the few alts with real world connections to large entities that people know about. If there was a token associated with the Eagles or the NFL it’d be one of the first things I bought, so I assume CHZ is similar for the euro bros with FC Barcelona & the soccer sport that they call futbol. People are always going to love sports regardless of any economic conditions and Chilliz captures a niche segment that utilizes NFTs to augment experiences that consumers love already. I considered StepN (GMT), the walking app that pays users for exercising if they’ve bought some of their digital shoe NFTs, but honestly haven’t looked closely enough at it to gauge how sustainable it is— maybe I’ll do that this week. If my memory serves right, they had a few million active monthly users at peak but admittedly I’ve never used the app myself. My favorite ecosystem is still Cosmos, which is where I think a lot of the alpha is currently since it is the least paid attention to out of all the major alts. I’m not going to write about them here but I recommend diving deeper into new projects that are coming out over the next few months. @CryptoCito, @zmanian, and @jackzampolin are good places to start on twitter, they’ll usually comment on or share a lot of the most pertinent things going on.

Merge and L2 alts like Lido Finance, OP, GMX, FOLD, and others have done really well the past two months and if we see chop on majors these should pullback as well. These should continue to be good plays going forward as they put in higher lows, especially the Arbitrum altcoins ahead of the Arbitrum Odyssey relaunch in September with the nitro network upgrade. ETH-DeFi like Uni/Aave/Link/SNX have also done well, with many having relevant fundamental catalysts. The bear market in Link/BTC, SNX/BTC that has persisted since the peak DeFi summer in August of 2020 appears to be ending now, similarly to how Link bottomed before BTC last bear market. Just spot ETH is probably the lowest risk play, if you’re still risk-off I’d take the time to test out some of the applications on these L2s with your stables while you wait for whatever you’ve deemed confirmation. It is very different to be risk-off and not doing anything rather than being risk-off and seeing what applications are attracting users even during downtrends. The Jackson Hole FED meeting may provide more clarity to markets with their opinion on the most recent data points that could align with what the market is pricing in, so will be paying attention to what they say on the 25th.

Majors: ETH, SOL

Memes: SHIB, DOGE

Large Caps: CHZ

Midcaps: XMON

Lowcaps: [redacted]

Hedges: BTC, APE

Watchlist

SNX, LINK, LDO, FOLD, GMX, SYN, SCRT, ETC, UNI, AAVE, IMX, OSMO, DPX, MATIC, BTRFLY

Looking Forward

Many of the trends over the past three years have been heavily driven by the current prevailing narrative capturing the market’s attention. Cobie wrote a great article describing this phenomenon in detail a few months ago.

The current narrative is the Merge, Q4 2021 it was the Metaverse/GameFi, but looking forward you should be considering what other narratives may be upcoming afterwards and how can you position for them ahead of time instead of reacting and developing a thesis that will likely only be determined by price movements. Considering all of the possibilities of where macro may or may not be headed, I came to the conclusion that I have no edge in predicting whether we will be in a deep recession in two quarters or all time highs in the SPX with a strong job market. I don’t think you need to predict whether CPI is going to be 8.5% yoy or 8.8% yoy, when you can instead evaluate the market’s response & FED’s reaction to each data point. Since the FED has consistently said that they will respond accordingly to their interpretation of the data and they believe we are close to neutral regarding the federal funds rate, it didn’t make sense to pigeonhole my bias one way if they aren’t doing so either. So if we do re-enter a bull market or some extended bear rally, then it follows that we’ll have similar rotations that we had in 2021 between different market metas. It is much more productive for me to spend time researching crypto protocols, so I’m not asleep at the wheel once trends begin to shift. I’ve compiled a list of possible narratives that I think could do well and I’ll try to order them time-wise somewhat, maybe I’ll write in more detail about them if I stay off of the bird app for longer.

Possible Future Market Narratives

- Sol 2.0 w/ localized account fee markets

- Optimistic Rollups v2: Arbitrum Nitro and Optimism Bedrock

- privDeFi: Aztec Connect, Secret Network, Penumbra, Mina + zkApps

- sudoSwap & jpegs shitcoining

- Interchain Security w/ Atom 2.0 + consumer chains like Neutron

- Interchain Accounts + interoperability between app chains

- rise of onchain options + derivs usage

- zkEVMs: Scroll vs. zkSync vs. Starknet vs. Polygon Hermez

- Move L1s: Aptos & Sui

- xApps & cross chain messaging wars: CCIP vs. Stargate vs. Synapse Chain vs. Connext vs. Wormhole vs. IBC

- Celestia & Sovereign Rollups

- dyMension and RollApps vs. Rollups

- modular execution rollups / FuelVM

- blockchain gaming alpha releases: Aurory, Illuvium, Treeverse, Strange Clans

- EIP 4844

Overall I think we have a decent window here for markets to continue doing well over the next month or so, and if the macro picture continues to improve then we have a ton of new narratives to latch onto. Let’s hope our tradFi bros have some more cash on hand to bid so our beloved BTC500 can stop selling off without pause.

Great article, was great to read it. Exactly the macro overview I needed.

Great article and thank you for writing again. As a fellow Eagles fan/Philadelphian I know you probably have some thick skin, and I appreciate you getting back out here and providing alpha. One comment I would make as it relates to the future market narratives is a big player entering the space and selling an "application" story that resonates. For example - https://therealdeal.com/2022/08/15/andreessen-horowitz-backing-adam-neumanns-bid-to-disrupt-resi-market/amp/ If someone can tie an issue that everybody believes (millenials can't own homes as they are too expensive) with crypto providing some sort of solution... that is one hell of a narrative change.